Demystifying the T2 Form: A Comprehensive Guide for Corporations

ntroduction: Just as individuals need to file income taxes, corporations are also bound by this obligation through the T2 form....

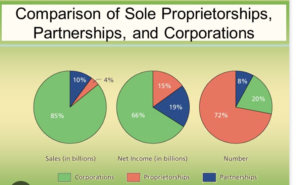

Tax Efficient Business Structures: Choosing Between Sole Proprietorship, Partnership, and Corporation

Introduction: When embarking on a business venture, one of the critical decisions to make is choosing the right business structure....

Navigating the Canada Workers Benefit (CWB) and Its Advanced Payments: A Comprehensive Guide

Introduction In Canada, the well-being of its citizens is a top priority, and one way the government ensures this is...

Ontario’s Luxury Tax Unveiled: Calculations and Illustrations

Introduction: The world of luxury automobiles beckons with sophistication and style, and in Ontario, the acquisition of high-end vehicles entails...

Navigating the Financial Landscape: How to Authorize an Accountant via Your CRA Business Accoun

Introduction: In the realm of business management, staying on top of financial matters is essential. From incorporation tax filing to...

Find Trusted Accountants Near You for Expert Financial Solutions

Searching for “Accountants Near Me” Introduction: When it comes to managing your finances and ensuring your business’s financial health, finding...

Steps to apply for Canada child Benifit(CCB) as a New comer

Step by step How can a new comer to canada apply for Canada child benefit(CCB) for first time If you...

How to Calculate Capital Gains Tax

In Canada, capital gains are considered taxable income and are subject to tax at a rate of 50% of the...