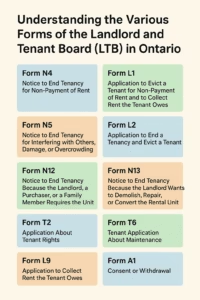

Form L1 – Application to Evict a Tenant for Non-Payment of Rent and to Collect Rent Owed (Ontario LTB Guide)

When a tenant fails to pay rent on time, landlords in Ontario can take action using Form L1 to evict the tenant and recover unpaid rent. This process, governed by the Residential Tenancies Act, involves strict timelines and procedural requirements. From serving the initial notice to enforcing an eviction order, understanding each step is crucial for both landlords and tenants. Discover how to navigate this complex process, protect your rights, and ensure a fair resolution. Whether you're a landlord seeking to reclaim lost rent or a tenant wanting to understand your options, this guide is essential for you.